- Meagan's Newsletter: The Gen Z POV

- Posts

- Bye Amazon... Hello Temu, TikTok Shop, and Shein

Bye Amazon... Hello Temu, TikTok Shop, and Shein

Chinese-owned apps are dominating the Top 10 charts on the U.S. App Store, with eCommerce at the center. Convenience is no longer "king"... it's price.

Welcome back to Meagan’s Newsletter: The Gen Z POV, where I break down trends, industries, and tech with a Gen Z lens every other week. I’m Meagan and I’m so happy you’re here. Today we’re diving into the rise of Chinese influence on U.S. eCommerce — what’s changing and why.

When you think of commerce in the U.S., these are probably the two biggest names that come to mind:

Walmart: world’s biggest retailer with $600Bn in TTM revenue, representing 6.3% of all eCommerce sales in the U.S. (2nd largest)

Amazon: world’s biggest eCommerce company, representing 38% of all eCommerce sales in the U.S. and with a massive $1.43Tn market cap

But when you look at the U.S. App Store, it paints a very different picture. Amazon (#22) & Walmart (#28) barely crack the Top 30. Instead, it’s Chinese-owned apps and stores that are winning the hearts (and wallets) of American consumers with the likes of Temu (#1), TikTok (#4), and Shein (#9).

We’re going to do a dive into this new wave of eCommerce because this is the future, as 96% of Gen Zers shop online 1x a month and 32% do it once a DAY. And China is winning more mindshare than ever.These new wave Chinese apps are coming to the U.S. because the overall retail market is larger here ($7.303 trillion in US vs. China’s $6.380 trillion) and eComm is growing faster (only 15.6% of US retail sales occur online compared with China’s 45.9%).

That’s not to say in-store retail is going away, but especially for younger consumers like myself, there’s just less of an emphasis/need. These are the only reasons I’m going to shop in-person at a store vs. online these days:

Limited edition (ie: Barbie x Zara merch, TS merch exclusive at the concert venue like the zip-up)

In-store only discount or reward that’s compelling enough

Last-minute purchase (ie: needed the Zara sneakers next-day for the TS concert, same thing with the lipstick & liner at Sephora)

Social activity with friends

All of my retail purchases from the past month (lots of TS stuff b/w Eras Tour & 1989)

Everything else is eComm, with purchasing decisions driven by convenience, price, FOMO, and influencers — meeting consumers where they are in the moment. And China is snatching this opportunity.

Now… let’s get into it! ⬇️

Temu (#1) & Shein (#9): Winning on PRICE

Here’s the quick TLDR on both companies:

Temu is the U.S. offshoot of Chinese e-commerce giant Pinduoduo, and has been #1 on the app store since it’s launch in Sept 2022 with over 50M downloads. Temu offers steep discounts on products from 100+ categories (not just fashion!), mostly shipped directly from Chinese factories or warehouses. Unlike Amazon, it takes 8-25 business days for products to arrive, and that’s obviously not why customers love Temu. They’ve risen to fame because of their “Team Up, Price Down” social sharing strategy, encouraging users to share the app with friends in exchange for credit to buy products (for free) on Temu — like $200 in free stuff w/o ever having to share your credit card info 🤯

Shein is a Chinese-owned company that’s become the new face of fast fashion, valued at $100Bn last year** and worth more than H&M and Inditex (Zara parent co) combined at the time. Shein is beating incumbents by making items more quickly and being more digitally savvy with customers — #SheinHaul has 12.1Bn views on TikTok and has become a go-to favorite for price sensitive Gen Z consumers. Your favorite singer could be wearing a cute dress on-stage, and the next day it’ll pop up on Shein’s site and in advertisements or influencer posts on your IG or TikTok. Their strategy is online-first, but they’ve recently been doing pop ups across the U.S. (with 2-4 hour wait times to enter the store)!

**note, Shein is now valued closer to $66Bn after it’s most recent funding round.

The Implications

In this highly inflationary environment, it makes sense that consumers are turning to low-cost alternatives like Shein & Temu — paired with the fact that Gen Zers are just starting to enter their peak spending/earning years (max 26 years old) and are generally cost sensitive.

However, these cheap products come with a price — on the environment, on storefronts here in the U.S., and even the way we shop.

Environmental & Labor Concerns: One study found that, together, Temu and Shein import 600,000 packages per day (!) to the U.S. that are under $800, thus avoiding tariffs and inspections, potentially hiding connections to forced labor. Both companies have gotten in trouble with the law when it comes to labor laws AND hate from consumers because of unsafe working conditions / damage being done to the environment (in producing 6.3 million tons of carbon dioxide a year in Shein’s case). This will likely be a continued trend with more boycotts & awareness around the harmful practices behind these companies.

The Way We Buy: We may begin to see more Chinese-influence in the way we shop and the products themselves — like group-buying (similar to grocery platform Weee! in the U.S. or Pinduoduo in China) to get better deals, or products with Chinese characteristics like “a rice cooker you can control from your phone.”

Reaction from Sellers: When you look at storefronts like Amazon that take more than 50% of revenues from sellers, you might see some sellers turn to other sales channels that’ll give them a bigger share of sales/profits considering platforms like Temu offer access directly to manufacturers.

Cementing Social Sharing: Social media & influencer marketing — be it recommendations from close friends or mass sharing on socials — has driven both of these companies into the cultural stratosphere, translating to both sales and downloads.

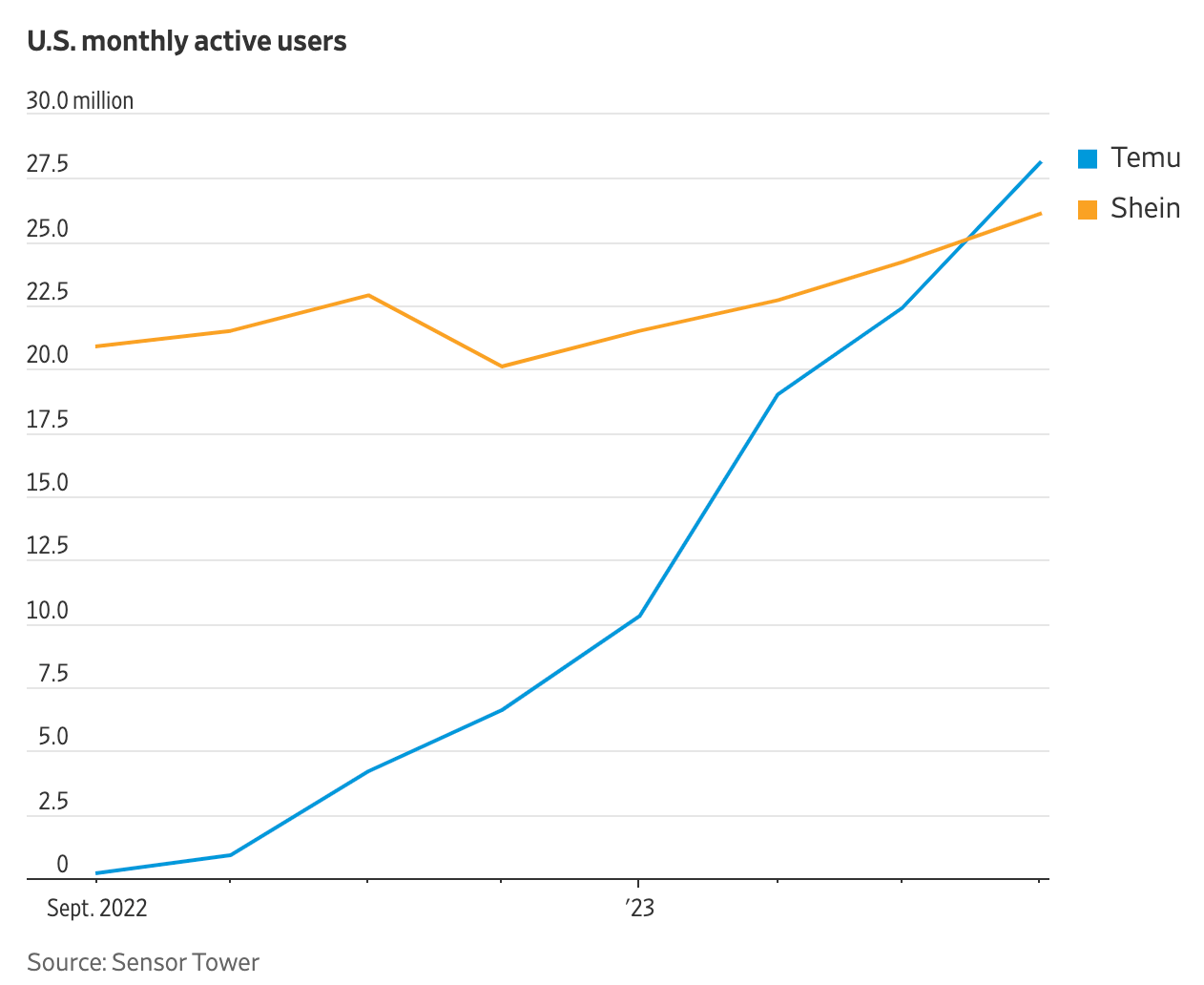

Temu and Shein are constantly at odds with each other in the U.S., with multiple lawsuits aimed at each other for things like unlawful competitive practices and trademark infringement… but Temu seems to be coming out on top when it comes to users and the charts.

TikTok Shop: Winning with SELLERS

Back in May, I did a whole deep dive on TikTok Shop and the future of social commerce which you can read here, documenting the arrival of the feature allowing people to buy products from small businesses within the app.

There have been 2 major evolutions to this strategy (and $470Bn opportunity):

Creators taking a cut: I previously detailed the importance of this channel for small businesses, but creators/influencers are starting to become sales vehicles in-and-of themselves and take a cut of each purchase they generate. This creator made 3 videos about the viral Srythm NC95 Headphones (available on TikTok Shop) totaling 10M videos, and made thousands in affiliate revenue. As you see products go viral with views + sales, more and more creators get in on the action to review products for commission.

TikTok selling their own products: TikTok is testing a new feature called “Trendy Beat,” which enables TikTok to sell their own products and apparel supplied by Chinese manufacturers — putting them in direct competition with Temu and Shein.

TikTok’s biggest advantage continues to be the army of creators that are incentivized to create content with commissions + billions of built-in buyers already watching TikTok videos.

I’m a perfect example, having bought things like lipgloss, sneaker cleaner, and even custom-made marshmallows directly from videos on the app. And many of the videos I’m seeing are from companies and/or influencers pushing products (chamoy gushers pop up on my FYP like every day, as do freeze dried skittles).

I always love looking at the app store charts to see what’s changing and if there are any underlying trends… and the fact that 4 apps in the Top 10 are Chinese-owned and 3 of which have commerce as a point of focus felt like a big change that I wanted to cover.

I personally don’t shop from Temu or Shein, but do like Shein-competitor Cider which has a more vintage style that aligns with the way I dress. However, I see way more Cider ads than I do Shein/Temu and end up purchasing more frequently as a result.

Unless we see government intervention or bans, this orientation around bargain buying (regardless of the source) feels like it will continue to make waves, and that Chinese companies are doubling down if anything on the opportunity.

And as promised, here are a few things (tech, culture & life) I’m intrigued by at the moment.

Tech: Intrigued by the rise of Fizz on college campuses — seems like the need for honest conversations & anonymity is trumping all else! Keeps coming up in my convos with folks currently in undergrad.

Culture: I meannnnnn the announcement of 1989 (Taylor’s Version) has been creating a ton of buzz between the easter eggs, new blue tour outfits on 8/9, and now the records she’s breaking in album sales right out of the gates.

Life: I went to The Eras Tour on 8/7 in LA and sat in the 2nd row of floor right near the diamond… highlight of my life & the post-Eras Tour depression is kicking in. But I have the entire night highlighted on my IG so I can re-live it over and over again!

Sources:

https://www.chron.com/culture/article/temu-18160784.php

http://www.cnn.com/2023/07/19/tech/temu-shein-lawsuits-intl-hnk/index.html

http://www.wsj.com/articles/fashion-giant-shein-raises-2-billion-but-lowers-valuation-by-a-third-1f8c316b

http://www.themarysue.com/shein-suing-equally-deplorable-fast-fashion-competitor-temu

http://time.com/6243738/temu-app-complaints

http://time.com/6247732/shein-climate-change-labor-fashion